Pushpa Telugu Movie Review, Rating

పుష్ప తెలుగు సినిమా రివ్యూ ,రేటింగ్

-

Indian Army Chief becomes General of Nepal Army!

-

Abhishek Bachchan Is More Like His Mother Jaya Bachchan ..?

-

CBFC Updated Film Certification System ..?

-

the management of Lucknow's Ekana Stadium got notice ..?

-

Student Sues 'Amaran' Team For Rs 1.1 Cr Over Incessant Calls By Sai Pallavi Fans ..?

-

she is taking five painkillers a day ..?

-

Hina Khan To Make An Appearance On Weekend ..?

-

AR Rahman's Son Slams Rumours About Parents Separation ...?

-

Khushbu Sundar Recalls A Shocking Incident As Newcomer ...!?

-

IPL auction start time changed after Jio Cinema request..!?

-

Kangana Ranaut Received Notice ..?

-

72 years of history..! 17 wickets at Perth Stadium..!!

-

Will "Kissik" item song rocks!!?

-

Sana Khan Pregnancy Announcement ...!?

-

Rashmika Mandanna's engagement video goes viral!!

-

IPL dates have arrived for the next 3 seasons..!?

-

Know everything about West Indies vs Bangladesh match!!!

-

Amaran tops in ticket sale than Vijay's Goat..!?

-

CA To Honour Late Australian Cricketer Ahead Of India-Australia

-

What's special about Naga Chaitanya - Sobitha's wedding?

-

Virat Kohli Sets Unwanted Record!!

-

They are still married', ARR divorce!!

-

SRK Shares Financial Struggles!!

-

Maharaja to become Tamil cinema's first Rs 1000 crore grosser..!?

-

Amitabh Bachchan reacted to Aishwarya-Abhishek Divorce ..?

-

Salman Khan Photoshoot With Father Salim Khan ..?

-

Rajasthan High Court gives relief to Shilpa Shetty ..?

-

This is how Naga Chaitanya and Sobhita Dhulipala's wedding will be ...

-

Shraddha Kapoor will do an item song in this film ..?

-

Tons of cinematic scenes in Gautam Adani's life..!?

-

Is the Reserve Bank of India releasing a Dhoni coin?

-

Rising prices are plaguing Canada..!?

-

Bumrah bowls like fire..!! Australia loses 4 wickets!

-

Actress Seetha's police complaint for jewellery theft..!?

-

Delhi started shivering! The situation is bad...?

-

Political attacks intensify amid Manipur violence...?

-

AR Rahman's first post after divorce from wife!!!

-

PIC TALK - Pooja Hegde Getting a New Hair Cut

-

Ellen DeGeneres Moves Out Of USA After Trump Won

-

Real Life 'Animal' Ranbir - Boy Takes on 4 Bullies In Front of his Sister

-

Train Disappeared Mysteriously After Entering The Tunnel With 104 Passengers - Mystery Unsolved Till Date

-

Kajal Aggarwal Reveals Why She Never Crossed The Borders With Her Co-Stars

-

Another Divorce? Virat Kohli Post Gives Heart Attack to Fans

-

Pooja Hegde Teases With Her Next...

-

Dramatic Video captures 5-Storey Building in Hyderabad Tilting dangerously

-

Divorce Lawyer Vandana Drops a Truth Bomb about South Celebrity Couple - "The Husband is a Tiger in Bed But..."

-

Groom Plays Séx Tape of Cheating Wife During The Wedding - VIDEO

-

How Safe It Is To Eat Your Favorite Panipuri? Know The Health Risks

-

PM Modi Was Aware of the Plot to Assassinate Khalistani Terrorist Nijjar - Indian Govt Denies Canada Allegations

-

India Lifts Ban on Salman Rushdie's 'The Satanic Verses'

-

Deepinder Goyal Trolled for Asking Job Candidate to Pay ₹20 Lakhs

-

VIDEO - A Biker Saved His Girlfriend During an Accident on Rainy Roads - VIDEO

-

Do You Like to Sip Coffee or Tea HOT ? CANCER is Near You..!

-

Modi Hater Shamita Yadav aka "Ranting Gola" who abuses BJP Gets in Trouble - Comes with Excuse

-

Billionaire Gautam Adani To Be Arrested in Bribery and Fraud Case !?!

-

Ind vs Aus: Broadcasting rights of Border Gavaskar Cricket..!?

-

Nayan & Dhanush went without speaking despite being close!?

-

Canada's another cheap trick..!? India's strong counter..!?

-

Problem between Dhanush and Keerthy Suresh..!?

-

Dhoni will be given a new post from CSK..!?

-

Bumrah replies in style to Australian reporters..!?

-

Italy's PM Georgia Meloni gave a big blow to China!

-

Maria Zakharova declined to comment on ICBM missile attack?

-

Saudi Arabia reprimanded Pakistan in such a way...?

-

PAK expert said - Our Foreign Minister is sobbing...?

-

Reason for AR Rahman's divorce by Bailwan Ranganathan..!?

-

Nayanthara thanked Chiranjeevi and Ram Charan..!?

-

How will the air pollution in Delhi be controlled?

-

Good people from other parties are welcome in AAP – Delhi CM Atishi

-

11th day of Nyay Yatra: Devendra Yadav and Alka Lamba targeted Arvind Kejriwal

-

Metro became the first choice of Delhi people against Air Pollution

-

Why Gopal Rai has described this situation as a medical emergency?

-

Who will win the Jharkhand Assembly elections?

-

Why Pappu Yadav made these allegations on Assam CM?

-

How much total property do Jharkhand Congress candidates have?

-

Video of clash between Vinod Tawde and BVA leaders surfaced in Internet

-

Flying squad recovered cash from the spot - Chief Election Officer

-

What has been the history of Bhiwandi seat?

-

'BJP is trying to win the election with money power': Nana Patole

-

A case of suicide over 'loan given in love' comes to light in Mumbai, Maharashtra

-

Why did Vinod Tawde go to Virar secretly?

-

FIR filed under Indian Code of Conduct against Vinod Tawde

-

Will Vinod Tawde been arrested in cash scandal case?

-

RSS started asking for votes in the name of religion: says Abu Azmi

-

Thinking about the welfare of India, 'Vote Jihad' should happen

-

Allahabad High Court is hearing 18 petitions related to Mathura dispute

-

GRAP-4 been implemented in NCR region due to Air Pollution

-

Vikrant Massey's ‘The Sabarmati Report’ praised by the audience

-

This South actress was the first choice for 'Jawaan'!

-

This actress got trolled for naming her second daughter!

-

Allu Arjun's film is available on this OTT platform!

-

AR Rahman used the hashtag, got badly trolled!

-

An elderly man complained to Akshay after casting his vote!

-

This is the condition of Kashmira Shah after the accident?

-

Singham Again Vs BB3: Who is ruling the box office after 20 days?

-

A R Rahman Religion: Why did AR Rahman adopt Islam?

-

On the set of 'Karan-Arjun', Rakesh Roshan trembled?

-

AR Rahman's pain spilled out after his marriage broke?

-

A new pill that significantly reduces cholesterol..!?

-

North India faces “poisonous air” threat..!?

-

RJ Balaji angered by that actor's speech..!?

-

Saindhavi said OK for GV even after the divorce..!?

-

Anirudh said no to Vijay's son Jason Sanjay..!?

-

The value of the Indian rupee continues to decline..!?

-

Lawyer breaks silence on AR Rahman rumour with Mohini Dey..!?

-

AR Rahman's Guitarist Mohini Dey announced her divorce..!?

-

Niki Aneja recalls Shah Rukh Khan visiting her in hospital ..?

-

Surabhi Jyoti Grand Welcome In Laws House ..?

-

These things were included in the invite ...?

-

Now the actress has reacted to the clash...?

-

Now the Chief Minister of Gujarat has also praised the film after watching it. ..?

-

This actress was the first choice, not Ash ..?

-

How is Govinda's health now after gunshot injury?

-

Raveena Tandon could not enter politics due to fear...!?

-

Kanguva Box Office Collection Day ..?

-

know what is the truth behind that photo...?

-

'The film made in the name of Ram', said Ekta Kapoor!

-

Fans mistook Virat Kohli's post for divorce announcement?

-

Kangana reacted to Shahrukh Khan's son Aryan's debut...

-

Govinda, Shatrughan and Rajesh could not become the 'King'?

-

AR Rahman Divorce: Daughter Rahima's reaction

-

Those who attack the police in Bihar should be cautious!

-

What is the chance of NDA's victory in Maharashtra and Jharkhand?

-

Giriraj Singh's big claim as soon as the assembly elections are over

-

CM Nitish Kumar overjoyed at India's victory in Asian Women's Hockey!

-

Good news for BJP alliance in Jharkhand!!!

-

2024: NDA government in 6 out of 10 exit polls...

-

Hopes of JMM-Congress alliance raised! NDA far ahead

-

Relief for Congress in Jharkhand Exit Poll after setback in Maharashtra?

-

Who will benefit from the increase in voting percentage?

-

Whose audio is it in the Bitcoin scandal? Ajit Pawar said this

-

Shinde, Thackeray or Pawar, who is the first choice for CM?

-

Who is the biggest party in Maharashtra? Exit poll figures surprised!

-

Nana Patole's big claim, 'Most Congress candidates will win elections'!

-

Balasaheb Shinde dies of heart attack at polling booth

-

MVA government is seen being formed in these exit polls?

-

Mahayuti or MVA, who got a shock, whose government?

-

SP will save its stronghold in UP, which party is getting an edge?

-

Will assembly by-elections be held again on this seat of UP?

-

'SP is just an army of goons and murderers'- Keshav Prasad

-

SP's big appeal, said- 'Go behind that vehicle...'!

-

After Kundarki, Mirapur, now there is a ruckus in Majhawan too?

-

Why did the policeman have to wave a pistol in Meerapur?

-

Bride refused to marry a boy who failed in high school!

-

BJP's first reaction on Exit Polls of Maharashtra?

-

Big decision of the State Election Commission!

-

Video of policeman waving pistol among voters in UP By-Polls

-

Delhi Woman Abducts a Boy and Abandons Him After Finding He's a Muslim

-

Afghan Immigrant Undresses Iconic Virgin Mary statue and Steals Golden Crown in Swiss - VIDEO

-

JAGUAR Changing Their Iconic Logo - Netizens Feel Biggest Downgrade

-

VIDEO - Lady Police Slaps a Guy and He Slaps Her Back Again!

-

18000+ Twitter Accounts Spread 'FAKE NEWS' for BJP and 147 for Congress

-

Doctors WARNING - Don’t Sit on the Toilet for More Than 10 Minutes

-

The Downfall Of India Without Even Being Invaded By Foreign Armies

-

Ahana Khan Runs a Séx Racket Under The Guise Of a Uniséx Salon

-

Do Lok Sabha polls give a true idea of the state of play in Maharashtra?

Empowering 140+ Indians within and abroad with entertainment, infotainment, credible, independent, issue based journalism oriented latest updates on politics, movies.

India Herald Group of Publishers P LIMITED is MediaTech division of prestigious Kotii Group of Technological Ventures R&D P LIMITED, Which is core purposed to be empowering 760+ crore people across 230+ countries of this wonderful world.

India Herald Group of Publishers P LIMITED is New Generation Online Media Group, which brings wealthy knowledge of information from PRINT media and Candid yet Fluid presentation from electronic media together into digital media space for our users.

With the help of dedicated journalists team of about 450+ years experience; India Herald Group of Publishers Private LIMITED is the first and only true digital online publishing media groups to have such a dedicated team. Dream of empowering over 1300 million Indians across the world to stay connected with their mother land [from Web, Phone, Tablet and other Smart devices] multiplies India Herald Group of Publishers Private LIMITED team energy to bring the best into all our media initiatives such as https://www.indiaherald.com

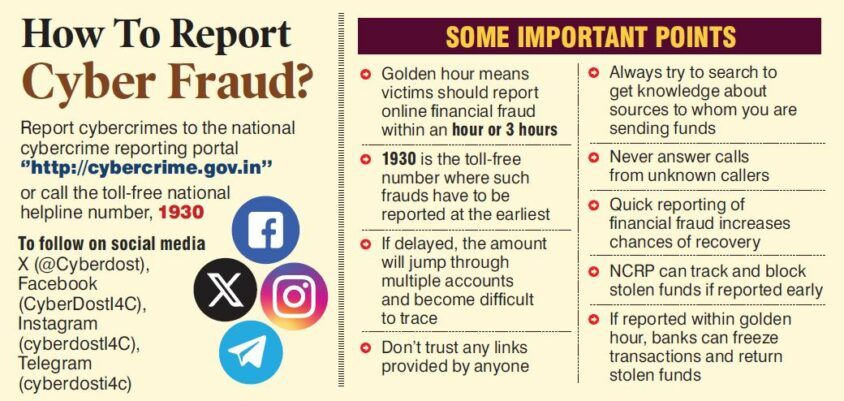

The hyderabad Cybercrime police are making every effort to raise awareness of the significance of notifying them through the 1930 hotline in good time, given the enormous potential of the golden hour rule in boosting the likelihood of retrieving misplaced assets.

The hyderabad Cybercrime police are making every effort to raise awareness of the significance of notifying them through the 1930 hotline in good time, given the enormous potential of the golden hour rule in boosting the likelihood of retrieving misplaced assets.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel