Pushpa Telugu Movie Review, Rating

పుష్ప తెలుగు సినిమా రివ్యూ ,రేటింగ్

-

Monkeypox creates panic, govt declares emergency...

-

Los Angeles engulfed in smoke, why fire become more terrible?

-

Despite plight of Indians in Ukraine war, Putin ignoring promises...

-

Why Pakistani girls calling people of India to their country?

-

6 Degree Celsius temperature recorded in Delhi

-

Why AAP Councilor Tahir Hussain got interim bail?

-

Sanjay Singh accused BJP for indulging in fake votes

-

Air quality in Delhi recorded in the severe category as 397

-

How much did 'Game Changer' collect on the opening day?

-

Did Game Changer brought down Pushpa 2: The Rule?

-

Khushi Kapoor’s ‘Loveyapa’ hits screens by February 7

-

How many Indians will be able to go on Haj pilgrimage this year?

-

126 people died in Tibet just 6 days ago, scary in Japan too...

-

Know the Worldwide collection of 'Pushpa 2: The Rule'

-

China played a trick in Bangladesh! India may face problems...

-

Chahal and Mahwash seen together on Christmas..Dating?

-

Premanand Maharaj praised Virat and Anushka

-

Why ‘Game Changer’ and ‘Fateh’ released on same day?

-

Game Changer been made in a mega budget of around Rs 450 crore

-

Will Salman Khan make a strong comeback with 'Sikander'?

-

Why Dhanashree Verma decided to divorce Yuzvendra Chahal?

-

Amid tension with India, big rebellion in Bangladesh Army...

-

Is Elon Musk buying TikTok..!?

-

Ajith speaks about Vijay in Dubai..!?

-

An important statement issued by actor Ajith Kumar..!!

-

How is the movie Kadhalikka Neramillai..!?

-

Prabhas Unveils Raja Saab's New Poster for Pongal!

-

Why Custom duty was reduced in the last budget?

-

Shares of Bharat Heavy Electricals Limited (BHEL) continuously falling

-

Is Russia stabbing us by helping Bangladesh..!?

-

Has TCS revenue increased by 6 percent year-on-year?

-

Will small breach in data security can cause huge loss?

-

5 bowlers with the most wickets in the Champions Trophy..!?

-

Will Zomato and Swiggy's new standalone apps cause harm?

-

Virat Kohli and Rohit Sharma's BCCI contract may be terminated..!?

-

Enterprises will sell its entire 44% stake in its joint venture Adani Wilmar

-

Thai Pongal Festival..!! A festival of happiness & prosperity..!!

-

This builder refused to give a refund or possession

-

Why role of humans reduced in the Customer Service of Banks?

-

Investment in Mutual Funds through Systematic Investment Plan reached all-time high

-

Microsoft announced to lay off one percent of its company's staff

-

The Unreal Downfall of Director Shankar

-

Will 2025 Budget reduce Tax Burden for Middle Class?

-

Why Americans Prefer Wood To Build Houses?

-

How This California Mansion Escaped From Wildfire? It's a Miracle

-

How Much Money Was Wated In Game Changer?

-

Can Game Changer Atleast Beat Pushpa 1 ..?

-

Greenback falls on report Trump group is mulling gradual tariffs

-

Kapil Dev shoots down 1983 global Cup teammate's arguable take on Bumrah's workload

-

Aaj Ka Panchang, January 14, 2025: Tithi, Vrat, Shubh Muhurat, And Ashubh Muhurat

-

Satisfied Pongal 2025: desires, snap shots, fame, And WhatsApp Greetings

-

Can CoinSwitch's Rs six hundred-crore plan help WazirX investors

-

North Korea launches missiles closer to japanese waters in 2d release of yr

-

HCL Tech's Q3 luggage 'hold' calls, Jefferies upgrades BSE

-

Jailer 2 Announcement - What to Expect?

-

Rahul no longer Pant's rival, Kuldeep's stiff check

-

Akhanda 2 shooting crucial episodes in Maha Kumbh Mela

-

Spain seeks to set one hundred% tax on non-european

-

Trump spoofs viral chat with Barack Obama

-

Nitish Kumar Reddy visited the Tirupati temple

-

Indian Rupee Hits Record Low Against US Dollar - Modi & Govt Spoiling India

-

'Game Changer' Team Moves With Cyber Crime

-

Sankranthiki Vasthunnam Review - A No-Brain Timepass Entertainer

-

This is the real reason for Ajith's decision..!?

-

Do not eat milk with fish..!? These problems will occur..!?

-

Ex-Trudeau Ally Jagmeet Singh Warns Trump Against US Tariffs On Canada ..

-

Indian team for the Champions Trophy series by Irfan Pathan..!?

-

Jayam Ravi changes his name..!?

-

Sai Pallavi missed the jackpot opportunity..!?

-

Nayan shows off her arrogance by arriving 6 hours late..!?

-

Ajith's promise to Vijay's son Sanjay..!?

-

AI girlfriend is available in the market..!?

-

Why Triptii Dimri has been dropped from Aashiqui 3?

-

Pat Cummins' Availability For Champions Trophy 2025...?

-

Candidate Rejected For Playing Guitar? COO Recalls Bizarre Hiring Decision

-

Case against Venkatesh and Rana Daggubati ...?

-

Anushka Sharma returned to Mumbai from Alibaug ..?

-

Tamannaah Bhatia Aces The Maximalist Trend In An Embroidered Bandhani

-

Aadar Jain and Alekha Advani tied the knot ..

-

Chinese School Asks Students To Sign "Suicide Disclaimer",

-

Mars Transit on 21st May 2025: Insights, Mantras, and Remedies

-

Hyderabad Vloggers' Sweet Surprise for Delivery Agents is Winning Hearts

-

Reverse Vada Pav: A Trend or Just Another Food Experiment?

-

Masa ba's daughter's name and its meaning ...

-

Jemimah Rodrigues' Guitar Celebration After Maiden ODI Century Goes Viral

-

Chandramouli was found dead by his band member ...?

-

Anushka Sharma Makes Frequent Trips Between Mumbai and Alibaug to Join Virat Kohli

-

Sonakshi Sinha Clarifies Pregnancy Rumours ...?

-

Jaya Bachchan On Amitabh-Rekha Affair Rumours ...

-

Maha Kumbh 2025: A Historic Gathering with Unprecedented Security Measures

-

Who is Karan Johar dating, the filmmaker himself revealed

-

Naga Chaitanya Cheers for Ajith Kumar's Dubai 24H Victory

-

PM Modi Inaugurates Z-Morh Tunnel, Highlights Kashmir’s Transformation

-

A model reached outside Amitabh Bachchan's house to stop the marriage...?

-

Eva Longoria extended a helping hand and donated $ 50,000 to the victims. ...

-

Photos of private moments leaked ...?

-

When Varun Dhawan kept kissing this actress even after the director said cut ...?

-

China's statement on virus..!? Sigh of relief!

-

No helmet, no petrol from January 26..!? Government order!

-

Want to work in Saudi Arabia? New changes in visas..!?

-

Budget for the year 2025 going to be presented on February 1, 2025

-

Do Manappuram Finance has a major stake in Ashirvad Micro Finance?

-

What did Rohit Sharma say in the BCCI meeting?

-

Will Investment in gold and silver benefit this year?

-

Pakistan has an advantage over India in the Champions Trophy..!?

-

Where has Swiggy's SNACC been launched?

-

Fixed Deposit (FD) is a great option for investors to invest

-

Last date for filing belated income tax return (ITR) slowly approaching

-

CBDT stopped giving tax rebate under section 87A to those taxpayers

-

Muthoot has the highest interest rate, Kotak Mahindra has the lowest

-

Case registered against Venkatesh and Rana Daggubati..!?

-

Jobs will grow by 2030 in roles related to Essential services

-

JSW Cement claims itself to be a producer of green cement

-

SEBI's investigation reveals shocking revelations about Stock broker

-

How did the Gold Import data go wrong?

-

Tencent Holdings is one of the most valuable companies in China

-

UBL iincurring losses in Telangana due to Kingfisher Beer

-

Know which Countries are ahead in terms of Gold reserves in the world

-

36 illegal Bangladeshi migrants caught in 15 days in Maharashtra

-

Confusion among the constituent parties of the India alliance - Sanjay Raut

-

Why these Bridges not been used by public?

-

Why Nitesh Rane has been giving controversial statements?

-

PM Modi Inaugurates Z-Morh Tunnel For All-Year Access To J&K's Sonamarg

-

EC stated how much political parties have spent in Maharashtra and Jharkhand Elections

-

Man Dressed As Firefighter Caught Robbing Home Amid Los Angeles Wildfire

-

Muslim Voters Percentage In Delhi ...?

-

The Army Chief told what is the plan now...?

-

Deal worth Rs 1.5 lakh crore!

-

What is Mahayuti's claim - decision was taken in cabinet meeting..?

-

A heart-wrenching incident has come to light from Maharashtra's capital Mumbai

-

Arvind Kejriwal raised questions on the Constitutional Institution

-

Many questions being raised about NDA alliance in Uttar Pradesh

-

Is SP-BJP eyeing BSP voters in Milkipur?

-

Quality of Food to be served during Maha Kumbh Mela

-

What about RLD’s entry in Delhi Elections?

-

Supported Chief Minister Yogi Adityanath's statement on the issue of Waqf

-

Important news for devotees visiting Kashi Vishwanath temple

-

Mulayam Singh Yadav's statue installed in Maha Kumbh

-

Firozabad Police sent more than 150 warrants to jail

-

How do Naga Sadhus live in the midst of severe cold?

-

What did Aniruddhacharya say on BJP leader's controversial statement?

-

Does Aniruddhacharya agree with RSS chief's statement?

-

Railways has made big preparations to ban non-veg food

-

Complete Information about the Bhogi Festival!

-

Boghi Rituals - How it is celebrated?

-

Kannauj accident-CM Yogi gave instructions to the officials

-

Australian team announced for ICC Champions Trophy!

-

Kannauj accident-Strict action will be taken against the culprits

-

Railways announces compensation for injured of Kannauj accident

-

'Game Changer' broke the record of 'Indian 2'!

-

Kannauj railway accident: Rescue lasted for 16 hours

-

What did the former BJP MLA say about Muslims?

-

Strange case come to light-fight between husband and wife!

-

Akhilesh Yadav shared the video of the Kannauj accident

-

Terrible fire in Greater Noida chemical factory

-

Blind people got a boon! Two students of UP made smart glasses!

-

Jangam Sadhus become the center of attraction in Prayagraj

-

Why did narrator Devkinandan Thakur express this wish?

-

CM Yogi's statement on first anniversary of Ramlala's Pran Pratishtha...

-

Akhilesh Yadav's first reaction, made a big demand

-

CM Yogi gave a befitting reply to the claims of Waqf Board

-

Akhilesh Yadav said- 'Negligence shown and this is result'

Empowering 140+ Indians within and abroad with entertainment, infotainment, credible, independent, issue based journalism oriented latest updates on politics, movies.

India Herald Group of Publishers P LIMITED is MediaTech division of prestigious Kotii Group of Technological Ventures R&D P LIMITED, Which is core purposed to be empowering 760+ crore people across 230+ countries of this wonderful world.

India Herald Group of Publishers P LIMITED is New Generation Online Media Group, which brings wealthy knowledge of information from PRINT media and Candid yet Fluid presentation from electronic media together into digital media space for our users.

With the help of dedicated journalists team of about 450+ years experience; India Herald Group of Publishers Private LIMITED is the first and only true digital online publishing media groups to have such a dedicated team. Dream of empowering over 1300 million Indians across the world to stay connected with their mother land [from Web, Phone, Tablet and other Smart devices] multiplies India Herald Group of Publishers Private LIMITED team energy to bring the best into all our media initiatives such as https://www.indiaherald.com

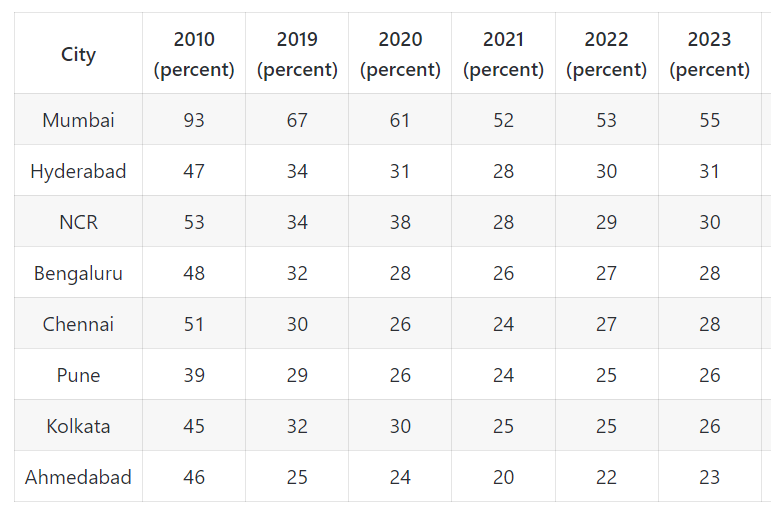

According to Knight Frank india Chairman and Managing director Shishir Baijal, "Stable affordability is essential to sustaining homebuyer demand and sales momentum, which, in turn, acts as a key economic driver for the country." Baijal was speaking about the affordability index. End-users' financial confidence is greatly enhanced when income levels rise and economic growth picks up, which motivates them to devote longer-term funds towards asset building. A steady interest rate environment combined with the RBI's robust 7.2% GDP growth prediction for FY 2025 means that income and affordability levels could sustain homebuyer demand in 2024.

According to Knight Frank india Chairman and Managing director Shishir Baijal, "Stable affordability is essential to sustaining homebuyer demand and sales momentum, which, in turn, acts as a key economic driver for the country." Baijal was speaking about the affordability index. End-users' financial confidence is greatly enhanced when income levels rise and economic growth picks up, which motivates them to devote longer-term funds towards asset building. A steady interest rate environment combined with the RBI's robust 7.2% GDP growth prediction for FY 2025 means that income and affordability levels could sustain homebuyer demand in 2024.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel