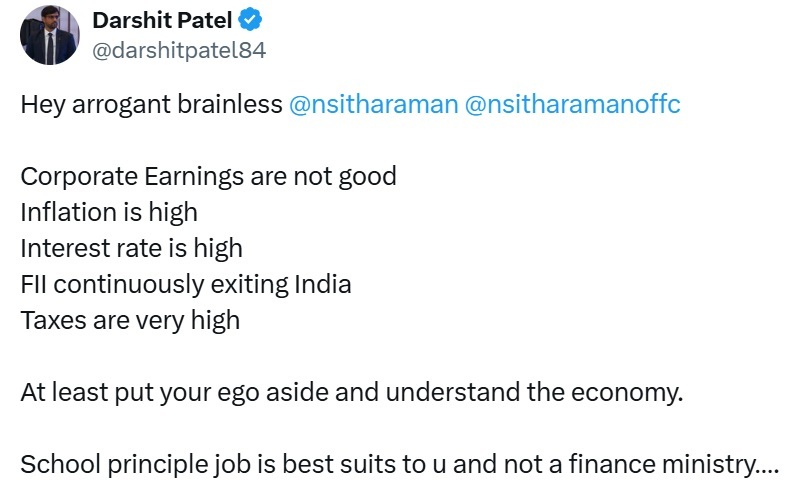

Such reactions often stem from the perception that economic policies are not adequately addressing citizens' financial hardships or supporting business growth. The user’s pointed comments, while extreme, capture a sentiment that some indians feel the government may be overlooking important economic indicators, and by extension, impacting the financial stability of households and businesses alike.

High inflation and interest rates have a cascading effect on consumers and businesses, resulting in increased costs of living and borrowing. corporate earnings, particularly in sectors sensitive to consumer spending and interest rates, tend to reflect these pressures, which can discourage investment and slow economic growth. The user’s reference to "corporate earnings not being good" and “FII [foreign institutional investors] continuously exiting India” further underscores this concern.

High inflation and interest rates have a cascading effect on consumers and businesses, resulting in increased costs of living and borrowing. corporate earnings, particularly in sectors sensitive to consumer spending and interest rates, tend to reflect these pressures, which can discourage investment and slow economic growth. The user’s reference to "corporate earnings not being good" and “FII [foreign institutional investors] continuously exiting India” further underscores this concern.Foreign investors pulling out of india can signal unease about the economic environment or concerns about profitability, impacting the indian market and weakening the rupee. For many, this presents a worrisome scenario, especially when combined with high taxes that may further reduce disposable income and investment potential.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel