This is a thorough analysis of ATM withdrawal fees and restrictions for the leading indian banks, such as sbi, hdfc, ICICI, Axis, PNB, and others.

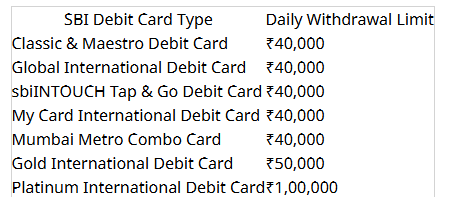

1. bank of india-Latest Updates, Photos, Videos are a click away, CLICK NOW'>state bank of india (SBI) ATM Withdrawal Limits & Charges

Withdrawal Limit: ₹40,000 to ₹1,00,000

Withdrawal Limit: ₹40,000 to ₹1,00,000ATM Fees: ₹20 + GST (after free transactions)

Foreign ATM Charges: ₹100 + GST + 3.5% of transaction value

Free Withdrawals at sbi ATMs: 5 transactions per month

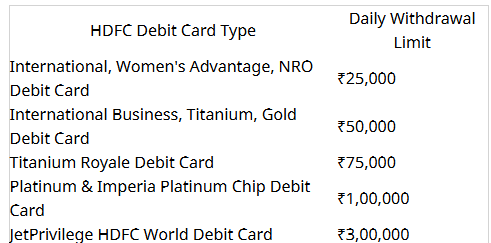

2. hdfc bank ATM Withdrawal Limits & Charges

Withdrawal Limit: ₹25,000 to ₹3,00,000

Withdrawal Limit: ₹25,000 to ₹3,00,000ATM Fees: ₹21 + taxes (after free transactions)

Foreign ATM Charges: ₹125 + taxes

Free Withdrawals at hdfc ATMs: 5 transactions per month

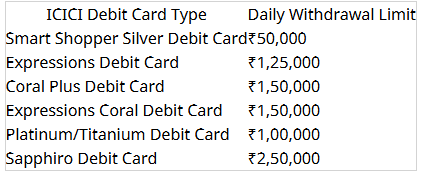

3. icici bank ATM Withdrawal Limits & Charges

Withdrawal Limit: ₹50,000 to ₹2,50,000

ATM Fees: ₹20 (per financial transaction after free limit)

Foreign ATM Charges: ₹150 + conversion charges

Free Withdrawals at ICICI ATMs: 5 transactions per month

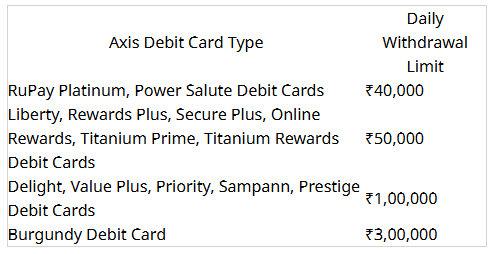

4. Axis bank ATM Withdrawal Limits & Charges

Withdrawal Limit: ₹40,000 to ₹3,00,000

ATM Fees: ₹21 per transaction (after the free limit)

Foreign ATM Charges: ₹125

Free Withdrawals at Axis ATMs: 5 transactions per month

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel