What You Should Know About the New TDS Deduction Rule

Form 13 for the fiscal year 2025–2026 has been made available by the Income Tax Department. Taxpayers, especially those on salaries, can use this form to request a lower or zero TDS rate. They can reduce the need for a refund claim by applying for this, which will guarantee that excess tax is not subtracted from their income.

To lessen their TDS burden, indian residents who make payments to non-residents can now use Form 15E, which the government has introduced.

Submission Deadline

For the fiscal year 2025–2026, Form 13 and Form 15E are now accessible. However, taxpayers are required to submit these forms by march 15, 2025, for the current fiscal year 2024–2025. The window for applying for a lower TDS certificate for FY 2024–2025 is closing.

Who May Submit a Form 13 Application?

Form 13 is relevant if

The amount of TDS withheld by your employer or other organizations exceeds your overall tax obligation.

Your income qualifies for lower TDS rates under certain tax sections.

By applying Form 13, an overpayment is avoided and just the appropriate amount of tax is withheld at the source.

How to Apply for Form 13?

Once you complete and submit Form 13, the Income Tax Department will issue a certificate specifying the correct TDS rate applicable to your income. This certificate must be provided to your employer, bank, or any institution deducting TDS so they apply the correct rate, thereby avoiding excess deductions and refund claims.

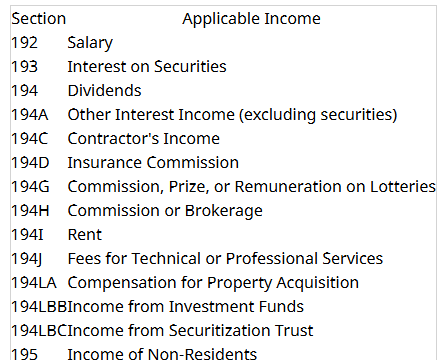

Eligible Income Categories for Form 13

Taxpayers with the following types of income can apply for a lower or zero TDS rate using Form 13:

Take Action - Now to Prevent Overpaying TDS

Eligible taxpayers must move quickly and submit their Form 13 applications before the deadline to avoid needless tax deductions. By lowering tax liability at the source, this action guarantees financial ease. Avoid missing the march 15 deadline by filing soon and effectively handling your taxes!

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel