The Post office Time Deposit (FD) can be a fantastic solution for you if you're searching for a high-yield investment that is safe and guaranteed. The Post office FD provides guaranteed returns with an alluring interest rate, much like bank fixed deposits. With a clever reinvestment plan, you may triple your investment of ₹5,00,000 in this 5-year Post office FD in just 15 years.

How does it operate?

How can an investment of ₹5 lakh yield interest exceeding ₹10 lakh?

What is the Post office FD interest rate?

Let's examine all the specifics of this lucrative Post office FD plan and see how you may make ₹15 lakh out of ₹5 lakh without taking any market risks.

Post office Time Deposit (FD): What is it?

The india Post office offers a fixed deposit plan called the Post office Time Deposit (TD), also referred to as Post office FD. It enables people to make investments with a guaranteed interest rate for a predetermined period of time. Higher returns are guaranteed because the interest is compounded quarterly and the term can be anything from one to five years.

Highlight: One of the greatest fixed-income investments available in india at the moment is a 5-year FD, which has an annual interest rate of 7.5%.

How to Earn ₹10 Lakh+ Interest on a ₹5 Lakh Investment?

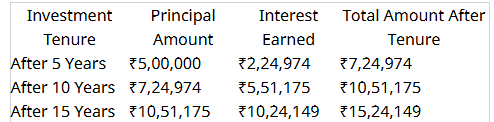

Now, let's break down the calculation of how your ₹5 lakh investment can triple in just 15 years with Post office FD.

Step 1: Invest ₹5 Lakh for 5 Years

Principal Investment: ₹5,00,000

Interest Rate: 7.5% per annum (compounded quarterly)

Maturity Value (After 5 Years): ₹7,24,974

Interest Earned in 5 Years: ₹2,24,974

What to do next?

After 5 years, you should extend the FD for another 5 years.

Step 2: Extend FD for Another 5 Years (10 Years in Total)

Opening Balance (After 5 Years): ₹7,24,974

Interest Rate (Applicable on Extension): As per prevailing rate (assumed 7.5%)

Maturity Value (After 10 Years): ₹10,51,175

Interest Earned in Second Tenure: ₹5,51,175

What to do next?

After 10 years, you should extend the FD again for another 5 years.

Step 3: Extend FD for Another 5 Years (15 Years in Total)

Opening Balance (After 10 Years): ₹10,51,175

Maturity Value (After 15 Years): ₹15,24,149

Interest Earned in Third Tenure: ₹10,24,149

Final Outcome: Your ₹5 Lakh Becomes ₹15 Lakh+

Total Interest Earned: ₹10,24,149

Total Interest Earned: ₹10,24,149Total Maturity Amount: ₹15,24,149

Return on Investment: More than 3 times your principal amount

What Makes This Trick Helpful?

Instead of withdrawing your FD, the solution here is to extend it twice every five years. With no more investment, this enables your interest to compound even further, giving you a huge return.

Key Takeaway: Without incurring any market risks, you would earn over ₹10 lakh in interest on your initial investment of ₹5 lakh in 15 years.

What Makes Post office FD a Good Investment?

The following are the main advantages of Post office Fixed Deposit (FD) investments:

1. Returns are guaranteed

Post office FD eliminates market risk by providing fixed and guaranteed returns.

2. Compounding Interest

Your money might expand dramatically over time thanks to the quarterly compound interest.

3. Secure Investing

Because Post office FD is fully supported by the government, your money is safe.

4. Simple Renewal

By extending your FD every five years, you can optimize your returns without having to reinvest new funds.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel