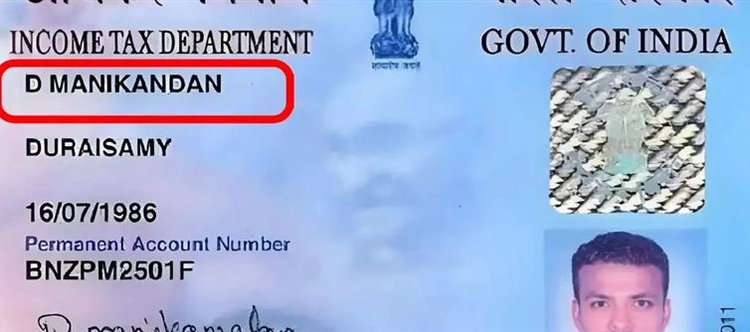

A Crucial Update for PAN Card Users

There is a significant change for you if you used your Aadhaar Enrollment ID to obtain your PAN card. People who utilized their Aadhaar Enrollment IDs are being reminded by the CBDT to obtain their PAN cards by october 1, 2024.

The following person must receive this information:

The Income Tax Department's System

An Authorized Official

Or go straight to the CBDT.

The PAN card and the associated Income Tax Return (ITR) may be deemed invalid if they are not updated in a timely manner.

Are There Going to Be Penalties?

The good news is that upgrading the Aadhaar number won't result in any penalties.

Recall that the general public had till june 30, 2023, to link their PAN with their Aadhaar; after that, there would be a ₹1,000 cost.

Those who used an Aadhaar Enrollment ID to obtain their PAN card, however, are able to alter their Aadhaar number at no cost.

What Takes Place If You Miss an Update?

If, before the deadline, you don't update your Aadhaar number:

You can lose the ability to use your PAN card.

Your income tax return (ITR) cannot be able to be filed.

There may be interruptions to banking and financial transactions.

Problems could arise with investments, real estate purchases, and sales.

How to Update Your Aadhaar Number?

Follow these simple steps:

Visit the official Income Tax Department website.

Enter your PAN and Aadhaar numbers.

Complete the OTP verification process.

Your Aadhaar number will be successfully linked.

If you have also received your PAN card using the Aadhaar Enrolment ID, make sure to update your original Aadhaar number before december 31, 2025.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel