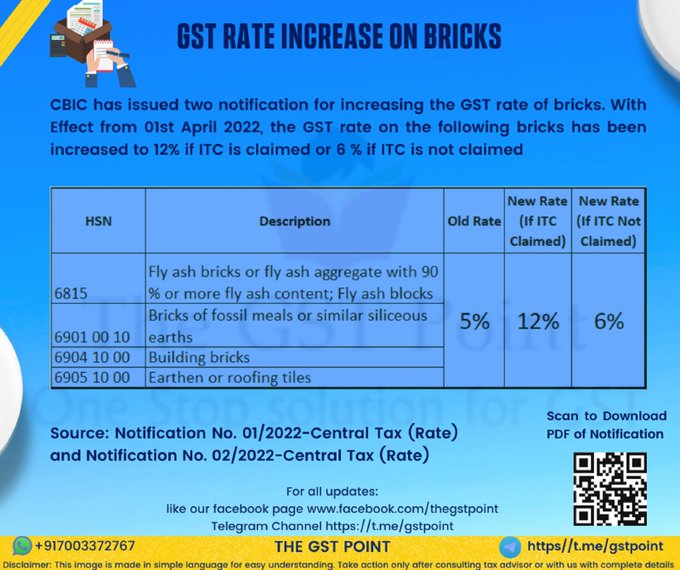

6 percent, or 12% tax

The GST on bricks has been raised from 5 per cent to 6 per cent and with ITC to 12 per cent. Brick manufacturers who do not want to go into the composition scheme can apply the 12 per cent tax with ITC. But one advantage of this is that you can take an input tax credit. ITC facility is not available at a 6 percent tax rate.

All bricks

This rule came into effect on april 1. Accordingly, the composition scheme applies to brick production, floor tiles, ash bricks, ash block, and bricks made of coal ash. So far, 5 per cent GST has been levied on brick production and trade. An input tax credit is also allowed to be taken. But, ITC can only claim if it falls within the 12 per cent expansion from now on.

Tax on Bricks: Bricks break the wallet!

The GST Council decided in september last year to bring the sale of bricks and products under GST and implemented them from april 1, 2022.

Inflation, rising prices

AMRG & Associates senior partner Rajat Mohana said, “Inflation is already high in India. Raising the tax to the current level would drastically increase the cost of bricks for construction. This will adversely affect the recovery and growth of the construction sector.

Real estate owners do not want to receive ITC. 6 per cent tax is payable when the compound goes into taxation. As a result, the price of bricks will rise sharply and the cost will be borne by the customers.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel