Pushpa Telugu Movie Review, Rating

పుష్ప తెలుగు సినిమా రివ్యూ ,రేటింగ్

-

Rajamouli Compromises For Priyanka Chopra

-

Aamir Khan Upset Due To His Flop Son

-

Fake Collections! No OTT Is Ready To Buy Akshay Kumar's Movie

-

JioHotstar - Not Fulfilling The Expectations?

-

Rocky Bhai Is Now Ravan - But...

-

Box-Office - Is Chhaava Bigger Than Pushpa 2?

-

No Confidence On Salman Khan's Box-Office Pull !?!

-

What's Happening To Prime Video? India Demands Netflix Model

-

DRAGON Producers Didn't Gave A Damn About Telugu Market

-

More Chaos On Hari Hara Veera Mallu

-

Are The Allegations On S.S.Rajamouli True !?!

-

Sabdham Movie Review - Another Second Half Letdown With a Jarring Glimax

-

All About The Séxual Allegations On S.S.Rajamouli

-

Prime Video Needs To Fix This Device Limit Immediately

-

Sikandar - Another Flop Loading For Salman Khan !?!

-

Amazon CEO Jeff Bezos's space trip with his girlfriend..!?

-

Suzhal Season 2 Review - Even More Gripping Than The Predecessor

-

AP Budget 2025: Minister Payyavula's special pujas..!?

-

The Monkey Review - If Creative Horror Kills Work For You, You Can Watch This

-

Social Justice Day for Telangana: Orders issued..!?

-

Aghathiyaa Movie Review - A Watchable Horror Comedy

-

Pooja Hegde Is A Clear Cut Beach Bum - Check Out

-

Rakul Preet Supports PM Modi And Advocates...

-

Pooja Hegde Storm Moves To Tamil Nadu From Telugu States

-

Pooja Hegde Make Big Demands For An Item Song

-

Japan Population crisis..!? Labor shortage..!?

-

BJP MLA Says Idly & Sambar Is The Reason For Tourists Decline In Goa

-

High Court of Jammu and Kashmir slams toll collection..!?

-

Actress Has Baby With Stepbrother She Married

-

Pakistan gets a huge prize money despite the defeat..!?

-

Pakistan avoids zero-point exit in Champions Trophy due to rain..!?

-

Delimitation: How Will This Shift Power In Parliament & Weaken Southern States?

-

Mumbai Society Increases Watchman's to Rs 16,000 - Reverses Decision After Neighbours Protest

-

FD, Interest Rates, LPG Price And Many More Rules Change From This March - It Will Affect Your Pockets

-

Mysterious 'Crying' Disease Is Killing People Within Hours - These Are The Symptoms

-

Shocking Footage Has Captured AI Robot Went Rogue And Attacking Humans

-

Meet Indian, Who Once Owned 2 Floors in Dubai's Burj Khalifa - Sold 12400 Crores Company For Just Rs 74 And Lost Overnight

-

He Ruined My Career For A Woman - Close Friend' Srinivasa Rao Accuses SS Rajamouli Of 'Harassment' In Suicide Note

-

All Works Related to Aadhar Card Can Be Done Without Aadhar - Just Send SMS To This Number

-

Pastor Accused Of Raping 15-Year-Old Minor - Used Church For His Séxual Desires

-

Muslim Woman Slaps Man 14 Times in 48 Seconds As He Touched Inappropriately In Kanpur Market

-

Layoffs - Infosys Gets Clean Chit From Karnataka Labour Department

-

Taking Dip At Maha Kumbh, Meeting Sadhguru - Shivakumar Responds: 'I Am Hindu, But...'

-

These 6 Indian Brands Are Commonly Mistaken To Be International

-

Mughals Came To India In 1526 - Do You Know Which Country They Resided Before That?

-

Starting At 76 Lakhs - These 5 Affordable Countries Offer Easy Citizenship For Indians

-

Meet Rubina Akib Inamdar, Mumbai Local's Woman Ticket Inspector Who Collected Rs.45k From 150 Ticketless Passengers In 1 Day

-

New Mystery Disease Kills People Within 48 Hours - WHO On Alert

-

Parents should never share these things with their children - It'll Impact Them

-

Shruti Haasan Enters Hollywood With 'The Eye' - Makes A Global Splash

-

These Are Four Most Cruel Rulers In History - There's A Woman Too...

-

Ananya Panday keeps it chic and fashionable in a Chanel outfit For Cover Shoot

-

Do You Know How To Apply For Birth Certificate? The Deadline ?

-

Samantha Is Done 'Being Away'

-

Investment, Rape and Blackmail - The Case Against Industrialist Shyam Sunder Bhartia

-

Take A Look At Pooja Hegde Dreamy Saree Looks

-

Government launches APAAR ID Card - How To Register & Download?

-

Do You Know The List Of Countries Offering Citizenship For Money

-

100 Crore Indians Have No Extra Money To Spend - Reports

-

You Can Move To USA Easily as US offering 'Gold Card' for $5 million - Indians React

-

A Major Séx Scandal Has Broken out in the USA - Might Shake Trump Govt

-

Earn ₹17 Lakh Without Paying Income Tax - Follow These Smart Strategies

-

Entrepreneur Living In US Explains Why He Returned To India After 10 Years

-

Home Rent Rules 2025 - How New Laws Will Benefit Tenants & Landlords?

-

Throngs Of Nakéd Men... - Shocking Video Of Katrina Kaif While Taking Dip At Maha Kumbh

-

Pune Rape - Unused MSRTC Buses Found Filled With Condoms, Alcohol Bottles

-

Maha Kumbh Leaves An Indelible Mark Not Just On Faith And Tradition But Also Economy

-

After 1000 Years Since Its Desecration By Mohd Ghazni, the sacred Somnath Jyotirlinga Resurfaced on Mahashivratri

-

Owner Of The Property Has The Right To Evict A Tenant Anytime - Supreme Court

-

Shah Rukh Khan, Gauri Khan Decide To Leave Mannat - They Will Now Live In...

-

'Bill Clinton should have resigned!', Monica Lewinsky...?

-

For the first time, Indians are benefited by Trump's decision!

-

Big announcement by Bangladeshi students!

-

Students studying from NIOS can also register for NEET UG!

-

Sonakshi Sinha Recalls Her Strict Household Rules ..?

-

Family Of Maharashtra Student, Battling For Life After Accident In US ..?

-

Supreme Court's question to the Center ..?

-

Raids in cryptocurrency scam case in Haryana ..?

-

He was smuggling gold worth Rs 1.3 crore ..?

-

Donald Trump Cabinet Meeting ..?

-

'There was an improvement after the Nirbhaya case but...'

-

More than 16 thousand trains operated ...?

-

This Salman Khan film was made in 25 lakhs, collected 12 crores at the box office ...?

-

Sikandar Teaser Twitter Review ..?

-

the matter is related to a love triangle ...?

-

Scientists have discovered a beach on Mars...!?

-

Pakistan-Bangladesh match canceled..!? Share Points after Washout?

-

IPL 2025: CSK captain Ruturaj is being trolled!?

-

Indian tricolor flag flutters in the heart of Pakistan..!?

-

The story of the film is based on Maha Kumbh ...?

-

Eyes clashed at a friend's party ..?

-

Jyotika Responds To Trolls Comparing Husband Suriya To Vijay ...?

-

Shahid Kapoor's pool party ..?

-

Do you know how much it costs now?

-

'Chhava' is creating a stir all over the world ..?

-

Let's know interesting facts related to his Mannat ..?

-

Priyanka Chopra rocked from Bollywood to Hollywood ..?

-

Digvijay Singh Rathi's ex-girlfriend accuses his fans, gives this warning ..?

-

Some of these beauties have earned more than 3000 crores worldwide.

-

NRIs in the U.S. Struggle with Job Security!!

-

Squid Game Returns and Dominates

-

Gemini To Electricity Siri With The Ios 18.4 Update?

-

Wireless 3 Superstar AC In 2025:

-

Nothing Cellphone 3a Launching On Four March:

-

Amazon Champion Up-To-Date! Built-In As Much As 50% Off

-

Want to Buy a House? Sell a Kidney!!

-

The Amazon Pre-Summer Bonanza Sale Is Live

-

Noise Grasp Buds: How To Get A ₹2,000 Cut Price At The Same Time As Pre-Ordering

-

Google Drive Rolls Out Video Transcription For Stronger Accessibility

-

Oneplus 13R Review: Misses Out On Fashion, Makes Up For It In Substance

-

Noise Grasp Buds Wi-Fi Earphones Evaluation:

-

The Viewsonic TD1655: A Reliable, Up-To-Date Portable Device That Gives You Seamless Overall Performance

-

How Pulses Are Dietary Powerhouses: The Fitness Blessings Of Pulses

-

Worn Out All The Time? These Superfoods Will Assist You In Living Energized

-

Ladies Need To Shave Facial Hair? Does it cause thicker regrowth?

-

O Wonderful Human Beings:

-

Is It Time for NRIs to Exit or Buy the Dip?

-

For Diabetic Sufferers, This Pulse Turns Into Poison As Quickly As It Enters The Frame, Not To Mention Eating It;

-

If You Need To Appear 30 At The Age Of 50, Then Begin Ingesting This By Including It In Milk From Today Itself!

-

The Maximum Lethal Oil In India: Reasons For 2 Million Deaths Annually

-

Devour Celery In The Way I Let You Know, And You Will Lose 20 Kgs Of Weight In 1 Month!

-

Is Your Blood Institution B+? Then Recognize These Nine Essential Matters!

-

The High-Quality Supply Of Calcium Can Even Eliminate Impotency From Its Roots

-

Special campaign for cleaning parks in Delhi!

-

Temperature started rising in Delhi, the hottest day!

-

Karkardooma Court acquits Shahnawaz of murder charges

-

Delhi Airport Terminal-2 may be closed for four months!

-

CM Rekha Gupta performed Rudrabhishek!

-

BJP raised the issue of broken statue of Bhagat Singh!

-

Theft of 96 branded watches worth Rs 40 lakhs revealed?

-

Ruckus over eating non-veg on Mahashivratri in University!

-

Manjinder Singh Sirsa's big allegation on Kejriwal!

-

Teacher and principal suspended for slapping child in school!

-

Delhi recorded the hottest day of the season!

-

Fire broke out in cinema hall during Chhaava movie!

-

Fares of domestic flights from Delhi airport will increase!

-

'Jailed Subrata kept enjoying facilities and...', Sunil Gupta reveals!

-

CM Rekha Gupta visited Gauri Shankar temple!

-

Delhi Metro gets big success, 97 meter tunnel!

-

BJP accuses MCD mayor of violating rules?

-

BJP's claim raises political temperature in Delhi, 'Majority in MCD...'

-

Pravesh Verma took charge of PWD department!

-

Virendra Sachdeva's big attack, said- MLAs unaware of rights?

-

Jhansi-Prayagraj rail route halted due to OHE line breakage!

-

DGP Prashant Kumar on completion of Mahakumbh!

-

Trivendra Singh Rawat also objected to controversial statement!

-

Main accused of gang demanding money to make arrested?

-

Abdullah Azam looked different, said this to supporters!

-

CM Yogi Adityanath tightened the screws on the officials!

-

Will this tradition related to Lord Shiva broken in Varanasi?

-

When will the lawyers' strike end in UP?

-

'Capitalists will capture the farmers', Rakesh Tikait accuses!

-

Maha Kumbh: Entry of 'Ravan' in the debate!

-

SP MLA compared UP's Shikshamitras to? BJP created ruckus

-

Kedarnath Yatra: When will the doors of Kedarnath open?

-

CM Yogi Adityanath active since 4 am, control room set up!

-

Heavy rain for next 3 days, weather changes in these districts!

-

New scam in 69,000 teacher recruitment?

-

JEE Predominant 2025 Consultation 2:

-

Weight Problems Crisis In India: PM Modi Urges Eating Much Less Oil, Six Tips For Selecting Proper Cooking Oil

-

Apple Is Bringing AI Functions To Its Imaginative And Visionary Headset In April:

-

Airtel Brings Apple TV+ and Tune for These Customers: A Way to Get It

-

Has Microsoft Discovered A Brand New State Of Dependence That Might Revolutionize Quantum Computing?

-

Microsoft Has An Unfastened Model Of Word And Excel, But You Won't Adore It

-

Google Is Sooner Or Later Converting SMS Logins For Gmail Users: All Info

-

How Bengaluru-Based Adarsh Builders Lost Information Stored In AWS: What Does It Say About Cloud Safety?

-

Boat Tag Clever Tracker For Android Devices Released In India: Rate, Capabilities

-

Lose Three To Four Kilograms In A Month With The Aid Of Walking For Just One Hour A Day

-

Can Eating Rice At Night Cause Weight Gain And Other Health Issues?

-

Get Glowing Skin And Healthy Hair Naturally With These Three Simple Remedies.

-

Realizing How Bad Intestinal Fitness Contributes To Pimples

-

7 Fish That Can Help You Shed Pounds

-

How Automated Truck Loading is Changing Logistics

-

Shruti Haasan Proves Her Versatility

-

Dragon Girl Joins Vishwak Sen

-

Dhanush Missed A Golden Chance

-

Mercedes-Benz Forced to Cut Jobs in China

-

Are India’s Billionaire Heirs Avoiding the Hustle?

-

Janhvi Kapoor opted for a laid-back and effortless style

-

KJ Yesudas's health rumors exposed by his son..!?

-

'Private' drone to the moon!? NASA to undertake a manned mission..!?

-

'Moroccan Nila powder' Brighten Your Skin - Have You Tried ?

-

Blake Lively mourns Michelle Trachtenberg's death

-

Official - Pooja Hegde to set the dance floors on fire with Rajini

-

H-1B Visa Scam - A Common Trap For IT Professionals

-

SSMB29 - Title And Press Meet Date Fixed !?!

-

Netflix Hits Big With OTT Views

-

NTR - Neel Story Leaked - Sure Shot?

-

What's Wrong With Netflix? Lost The Plot?

-

No Real Value For Villain On OTT !?!

-

Pradeep Ranganathan's Entry Into Top Tier Actor's Club Shocks All

-

IPL 2025 - Farewell Season For Dhoni Without CSK Win !?!

-

Despite Chhaava Box-Office Storm, A Little Surprise!

-

How Feeling Remote Influences Your Stress Reaction.

-

Cult Classic Returns To OTT - You Can Stream On...

-

Chaava - Non-Stop Rant On A.R.Rahman

-

The Last Big Challenge Completed By Balayya

-

Daaku Maharaj - No Cuts But Unnecessary Noise

-

Another Chaava Controversy Erupts

-

Samantha talks about returning to her ‘first true love’

Empowering 140+ Indians within and abroad with entertainment, infotainment, credible, independent, issue based journalism oriented latest updates on politics, movies.

India Herald Group of Publishers P LIMITED is MediaTech division of prestigious Kotii Group of Technological Ventures R&D P LIMITED, Which is core purposed to be empowering 760+ crore people across 230+ countries of this wonderful world.

India Herald Group of Publishers P LIMITED is New Generation Online Media Group, which brings wealthy knowledge of information from PRINT media and Candid yet Fluid presentation from electronic media together into digital media space for our users.

With the help of dedicated journalists team of about 450+ years experience; India Herald Group of Publishers Private LIMITED is the first and only true digital online publishing media groups to have such a dedicated team. Dream of empowering over 1300 million Indians across the world to stay connected with their mother land [from Web, Phone, Tablet and other Smart devices] multiplies India Herald Group of Publishers Private LIMITED team energy to bring the best into all our media initiatives such as https://www.indiaherald.com

Taking loans from banks was a huge task during the lockdown, so many people used fintech apps to get loans online very easily. You can get a loan online instantly by filing a few documents from the comfort of your home. Due to technological development, these start-up fintech apps made it easy to get small loans instantly without huge documents.

Taking loans from banks was a huge task during the lockdown, so many people used fintech apps to get loans online very easily. You can get a loan online instantly by filing a few documents from the comfort of your home. Due to technological development, these start-up fintech apps made it easy to get small loans instantly without huge documents. Fintech apps have also introduced various schemes to attract their customers and it is worth noting that the customers were initially given small amounts that could be paid back in a short period of time. Deduction of this amount from salary, interest-free or low-interest repayment in case of a short repayment period offered many benefits.

Fintech apps have also introduced various schemes to attract their customers and it is worth noting that the customers were initially given small amounts that could be paid back in a short period of time. Deduction of this amount from salary, interest-free or low-interest repayment in case of a short repayment period offered many benefits.  It also extended the loan repayment period from 3 to 6 months as requested by a few customers. So people used to borrow and repay through fintech apps to meet their cash needs. Many customers trust this app and take loans because it is confirmed that there is no fraud in the fintech app like other online apps.

It also extended the loan repayment period from 3 to 6 months as requested by a few customers. So people used to borrow and repay through fintech apps to meet their cash needs. Many customers trust this app and take loans because it is confirmed that there is no fraud in the fintech app like other online apps.  While it used to be a big job to go to a bank and take a personal loan or another type of loan, small amounts of money were easily obtained through fintech applications without any major documents. As the number of people taking loans through fintech applications is increasing day by day, they are able to pay back the loan of those applications within the specified period.

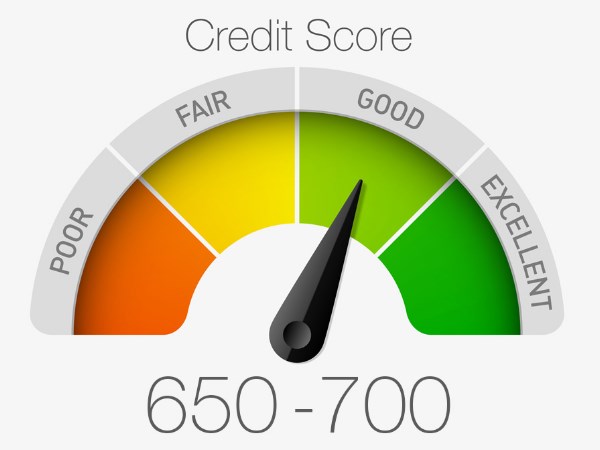

While it used to be a big job to go to a bank and take a personal loan or another type of loan, small amounts of money were easily obtained through fintech applications without any major documents. As the number of people taking loans through fintech applications is increasing day by day, they are able to pay back the loan of those applications within the specified period. Awareness is also being created now that if repayment is not made, there is a possibility of a bigger problem.It is also said that if a loan is not paid back on time, especially after taking a loan on a fintech app, the CIBIL score will go to the underworld. It is said that taking a loan through a fintech app will immediately reflect on the CIBIL score and if not done properly it will affect the CIBIL score significantly.

Awareness is also being created now that if repayment is not made, there is a possibility of a bigger problem.It is also said that if a loan is not paid back on time, especially after taking a loan on a fintech app, the CIBIL score will go to the underworld. It is said that taking a loan through a fintech app will immediately reflect on the CIBIL score and if not done properly it will affect the CIBIL score significantly.  Therefore, it is advised to note down the due dates of the loan and pay it on time to keep the CIBIL score in good condition.But at the same time if you have a bad CIBIL score before using fintech apps then it is advised to take a small loan on fintech apps and pay it off properly which will help you recover your bad credit score.

Therefore, it is advised to note down the due dates of the loan and pay it on time to keep the CIBIL score in good condition.But at the same time if you have a bad CIBIL score before using fintech apps then it is advised to take a small loan on fintech apps and pay it off properly which will help you recover your bad credit score. It is now being said that the number of people who have bought short-term loans through fintech apps a few times and paid them off correctly has increased their CIBIL scores. So it is important to note that if you use fintech apps correctly you may not lose your CIBIL score and you can recover a bad CIBIL score.

It is now being said that the number of people who have bought short-term loans through fintech apps a few times and paid them off correctly has increased their CIBIL scores. So it is important to note that if you use fintech apps correctly you may not lose your CIBIL score and you can recover a bad CIBIL score.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel