Problem for human beings with two financial institution debts! Hefty high-quality can be Imposed? Panic Over RBI's assertion.

Penalty for two bank bills: Many people in india have a couple of financial institution account. This news-that if you have a couple of bank account, you would possibly ought to pay a pleasant-may want to purpose concern among people.

in particular for those operating in non-public corporations. typically, the majority running in non-public groups have multiple financial institution debts. this is because every time you turn agencies, your new organization opens your revenue account with their tie-up financial institution. As a result, a few humans end up commencing accounts in two, 4, or even 5 banks.

what's the declare?

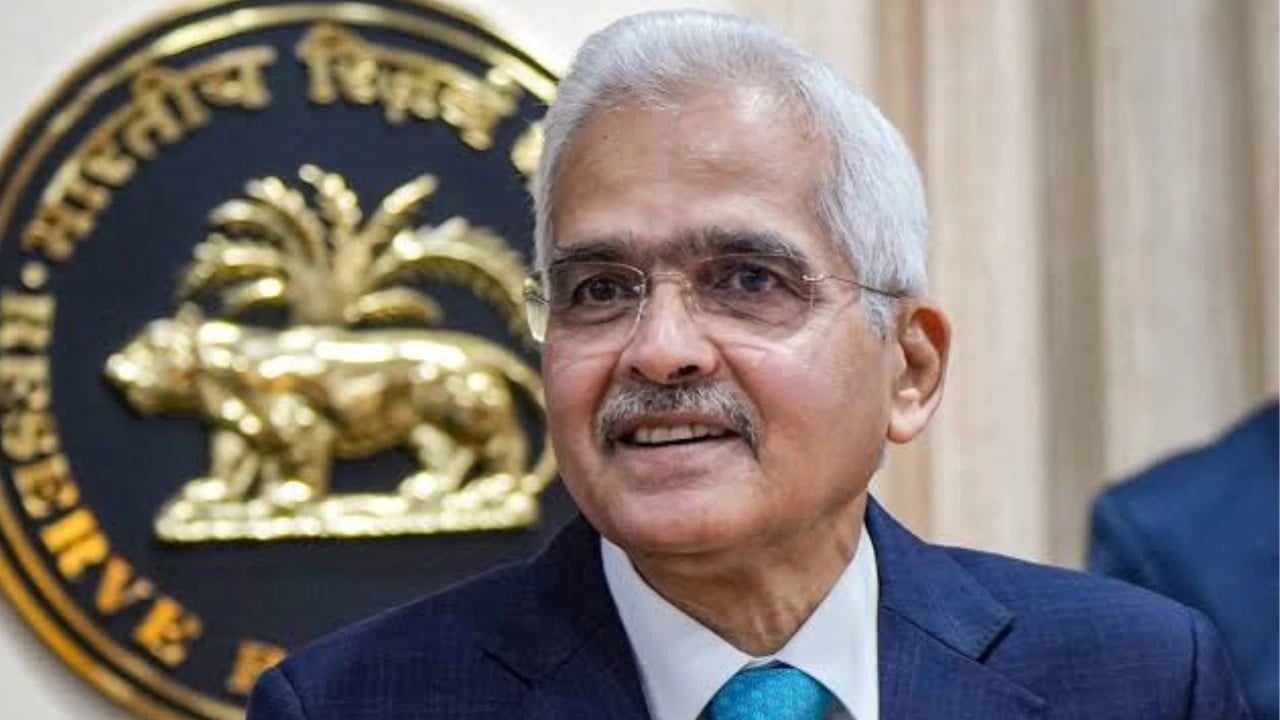

these days, a social media submit has long gone viral, claiming that when you have multiple financial institution money owed, you may face a penalty. The declare mentions former RBI governor Shaktikanta Das and alleges that RBI has issued new suggestions pointing out that individuals with two bank accounts may be closely fined. allow's find the fact at the back of this claim.

what is the fact?

PIB (Press facts Bureau) carried out a truth test on this declare. On Sunday, PIB declared this claim to be faux. PIB said that some articles are spreading this false perception that having financial institution accounts could bring about a best. but, RBI has issued no such tips. In other words, the claim is completely fake. PIB counseled people to avoid such news and rumors.

what number of financial institution money owed Can a person Have?

In india, there's no fixed limit on what number of bank accounts a person could have. you may open as many accounts as you want or need. RBI has no longer set any restrictions for this. however, you want to manage all of the money owed you open. this indicates you ought to maintain a positive stability in them. Failure to accomplish that should affect your credit score (CIBIL score).

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel