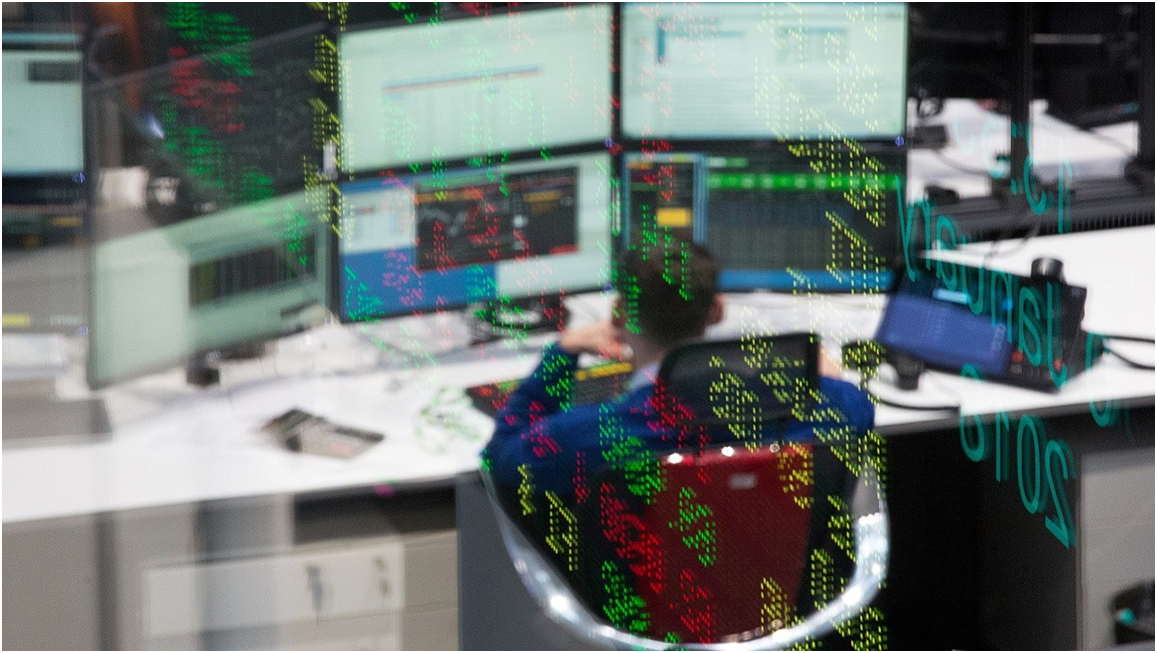

Shares hovered close to consultation highs as oil sank after President donald trump urged OPEC to lower crude charges and said he'll push for hobby-fee cuts.

A slide in oil, which has a tendency to ease issues approximately inflation, additionally helped push the coverage-touchy two-yr yields down. Equities saw moderate profits, with the development curbed by a selloff in chipmakers as a susceptible outlook from SK Hynix Inc. left traders thinking whether or not demand for synthetic intelligence will stay up to sky-high expectations. That warning at the enterprise spilled over into Europe, where ASML holding NV tumbled on worries over similarly US export controls.

Trump stated he would ask saudi arabia and other OPEC nations to "bring down the value of oil" and reiterated his risk to apply price lists to deliver manufacturing returned to the usa as he addressed global leaders gathered in Davos. He additionally said he might demand an immediate drop in hobby charges, which he said had ratched up deficits and ended in what he cast as financial calamity below the Biden administration.

The S&P 500 brought 0.2%. The Nasdaq a hundred slid zero.2%. The Dow Jones commercial average rose zero.6%. A Bloomberg gauge of the "brilliant Seven" was little changed. The Philadelphia stock change Semiconductor Index retreated 1.%. The Russell 2000 superior 0.2%.

The yield on 10-year Treasuries advanced two basis points to four.sixty three%. The Bloomberg greenback Spot Index fell zero.2%. Bitcoin rose 1.6% to $one hundred and five,707.seventy six.

The S&P 500's current leg better overlooked an essential factor: inflows from big-money managers. For those making a bet on a similarly rally, that's a welcome development.

A degree of mixture positioning among rules-based totally and discretionary traders fell to a -month low, in step with Deutsche bank AG's facts. And commodity buying and selling advisors cut their long inventory publicity to the level final visible within the aftermath of a market rout in August, information compiled by Goldman Sachs group Inc.'s trading table display.

From a contrarian perspective, such skepticism bodes properly for stock-marketplace bulls because it way extra dry powder to buy equities down the road, must the biggest fears fail to materialize.

at the financial front, records confirmed the quantity of american citizens on gain rolls climbed to a extra than three-12 months high, while first-time programs for US unemployment insurance edged better.

"Jobless claims may additionally have amazed slightly to the upside, but they had been nicely inside the modest range set up in recent months," said chris Larkin at E*alternate from Morgan Stanley. "Employment continues to focus on US economic outperformance."

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel