Are FIIs really keeping distance from the indian stock market?

For many months, it has been heard that foreign institutional investors (FIIs) are continuously selling their shares in the indian stock market. While the truth has come out that they are selling big stocks and investing in small and mid caps. december quarter data has shown that FIIs have increased their stake in 9 companies of Nifty 50, while they have sold their shares in the remaining 41 companies.

Increased stake in small and mid cap stocks

According to a report by Moneycontrol, FIIs have increased their stake in only 26 companies out of Nifty 100 companies. Whereas in contrast, FIIs have increased their investment in 44 percent of the companies of BSE Mid Cap Index and 55 percent of the companies of BSE Small Cap Index. FIIs have increased their stake in 466 of the 937 companies of the BSE Small Cap Index, while they have sold their shares in 425 companies. Their position remained the same in the remaining 46 companies.

Investment in IPO has increased

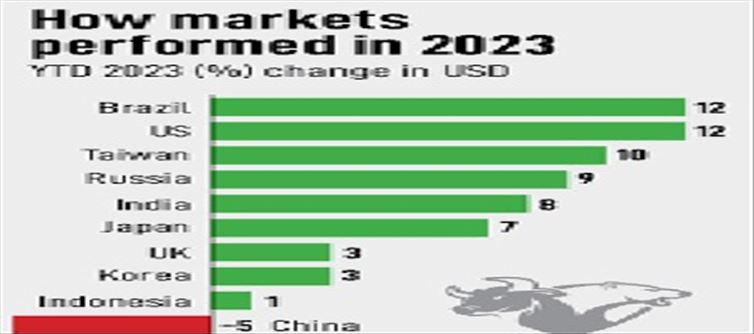

Earlier, only retail investors used to invest heavily in small caps, but now, seeing the greater opportunity for profit in these shares, FIIs are also investing in them. Now the question arises that why have FIIs changed their strategy regarding investment? In fact, the data of the december quarter shows that even though FIIs sold shares worth Rs 1.56 lakh crore in the stock market, they invested Rs 55,582 crore in IPOs in return. This is because IPOs have given 50 to 80 percent returns on listing and in some cases even up to 100 percent. On the other hand, the return in big stocks was only 10-15 percent.

There is a possibility of the trend changing again

In fact, due to India's slow economic growth, weak december quarter results and uncertainties like US tariffs, the inclination of FIIs towards the indian stock market has reduced somewhat, but this trend may change in the next few months because india is the fastest growing economy in the world.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel