Changes in tax slabs will increase your in-hand salary!

Finance minister Nirmala Sitharaman, while giving relief to the taxpayers in the budget presented today, said that now there will be no tax on income up to 12 lakhs. This announcement in the budget brought smiles on the faces of millions of middle class families of the country. This is not just a policy change, but the lifeline of the common man of the country.

The middle class gives strength to the economy

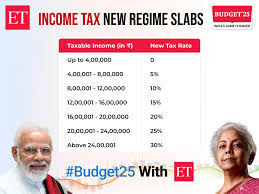

The role of the middle class of the country is considered important in accelerating the economic development of the country. Talking about this, the Finance minister said, "The middle class of the country gives strength to the economy. Considering their contribution important, we have given them some relief from the burden of tax." With this announcement of the government, those earning up to Rs 12 lakh will now save Rs 80,000 annually. Under the new tax regime, those earning Rs 12.75 lakh annually do not need to pay a single penny of tax. However, if the annual income is even one rupee more than Rs 12.75 lakh, then they will have to pay 15 percent tax.

This change in the new tax regime has also provided some relief to those whose annual income is up to Rs 18 lakh. Their tax savings in a year will be Rs 70,000. Similarly, the tax savings of those earning 25 lakhs annually will also be Rs 1,10,000, which is currently 25 percent of their tax liability. Through Budget 2025, the government has indicated that this is not just a fiscal adjustment, but it is also to support those who contribute to the economic backbone of the country.

Know who will benefit how much?

Under the new slab, earlier those earning 15 lakhs annually had to pay Rs 1.30 lakh tax, but now only Rs 97,500 will have to be paid. That is, these people will save Rs 32,500 on tax. Similarly, those earning 17 lakhs will now have to pay 1.30 lakh tax instead of 1 lakh 84 thousand. That is, their tax savings are 54,600 rupees. Similarly, those earning 22 lakh rupees annually will save 1,00,100 rupees on tax after the new slab. Those earning 25 lakh rupees annually will now have to pay only 3 lakh 19 thousand 800 rupees in tax instead of 4 lakh 34 thousand 200 rupees. That is, there will be a direct benefit of 1 lakh 17 thousand 400 rupees. Let us tell you that the amount calculated after TDS and other deductions is called net salary or take-home salary.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel