How is there zero tax on income of Rs 12 lakh?

After the Union Budget was presented in parliament on saturday (1 february 2025), bharatiya janata party mp manoj tiwari has been continuously praising it. Now he has surprised everyone by giving a statement on this. He has said that a friend of mine asked me how is it possible that someone does not have to pay even a single rupee of income tax on an income of Rs 12 lakh? Answering this question, he said that this used to happen earlier too. Know how?

bjp mp manoj tiwari, while answering his friend's questions, said, "My brother, this used to happen on paper earlier too, but it used to happen in a roundabout way." Further, he said, "We all know that we can give 8 percent of the budget to welfare schemes, but other governments did corruption in this. This was the place where instead of providing facilities to the public, people did corruption. By doing this, he even went to jail while being the CM. His future also ended. Now the coming generations will also make allegations in his name, which is not considered good to put in someone's name. "

This will happen by improving TDS and TCS

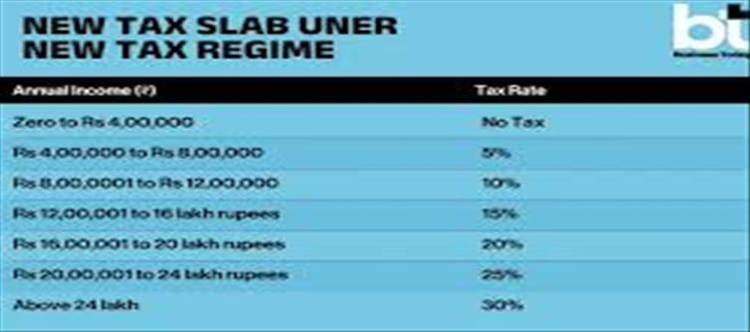

Actually, in Budget 2025, the central government has given a big relief in income tax to the common man, middle class and employed people. Union Finance minister Nirmala Sitharaman announced on saturday that the Modi government is going to improve the TDS and tcs system. TDS deducted on salary will be reduced.

According to the announcement of Finance minister Nirmala Sitharaman, now FD deduction of one lakh has been done. Not only this, it was also announced to increase the money sent abroad to ten lakhs. tcs will now be deducted only on those without PAN. Apart from this, the facility of updated returns has also been provided, which will benefit 90 lakh taxpayers. Updated returns can be filed again in the assessment year up to four years.

In Budget 2025, now no tax will be levied on taxpayers if they have 2 properties. Till now it was limited to only one property. The tax exemption limit for senior citizens has been increased from Rs 50 thousand to Rs 1 lakh. The exemption for filing ITR has been increased from Rs 5 lakh to Rs 10 lakh.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel