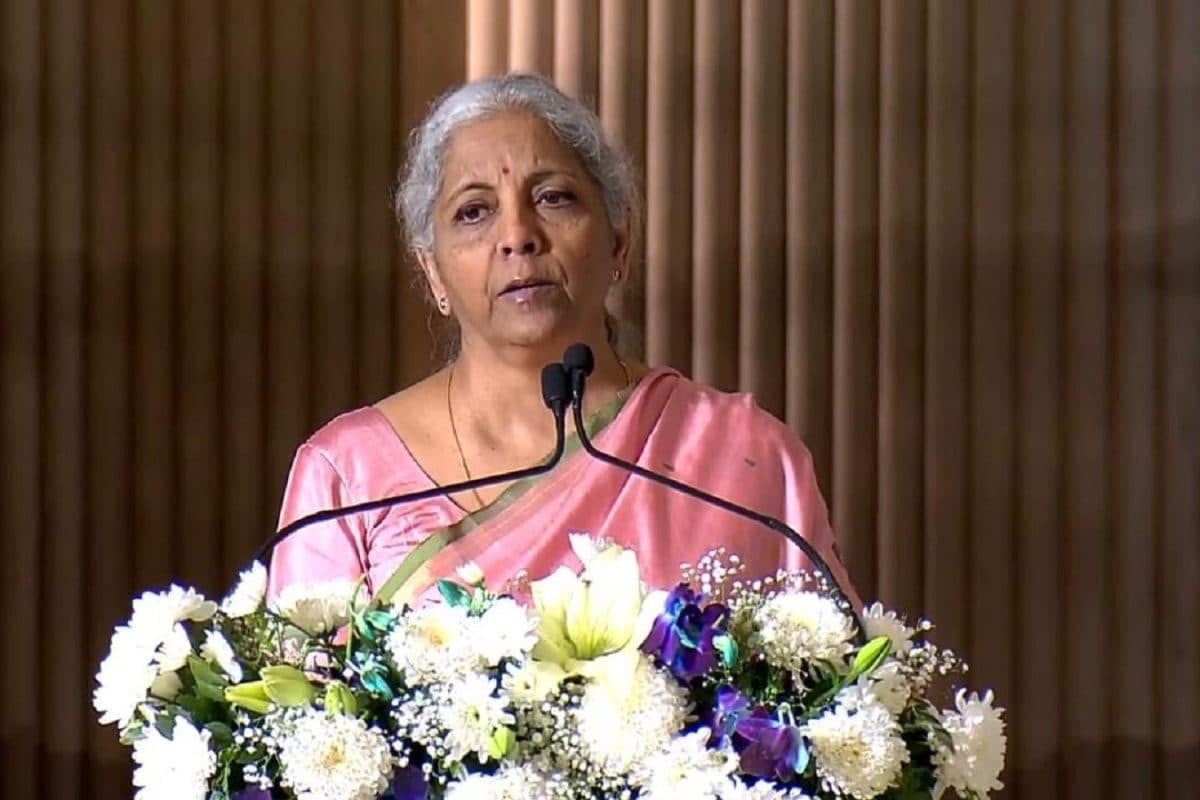

FII selloff pushed by using profit-reserving as india handing over 'proper returns': FM Nirmala Sitharaman

Finance minister Nirmala Sitharaman addressed the recent outflows in India's equity markets, attributing them to the strong returns investors are reserving, particularly foreign institutional traders (FIIs) who are benefiting from the contemporary monetary climate.

Speaking at a put-up-price range press conference on Monday, Sitharaman stated that the indian economic system is providing attractive returns, which in part explains the continued withdrawals with the aid of FIIs. She also emphasized that india is committed to becoming an investor-pleasant use of a, noting that several measures have been taken in the latest years to rationalize customs obligations.

on the grounds that in october 2024, overseas portfolio buyers (FPIs) have sold approximately ₹2 trillion worth of indian equities, contributing to a decline in the market from its highs. In the first six weeks of 2025 by myself, FPIs have offloaded over $10 billion (around ₹97,000 crore) worth of indian stocks. The selloff is broadly speaking driven by using slowing company income and changes in U.S. policies that have made U.S. debt securities greater attractive, strengthening the dollar and diverting investment away from emerging markets. As a result, the benchmark Sensex has dropped by around 12% from its all-time high in september 2024.

Finance Secretary Tuhin Kanta Pandey commented that FPI actions are prompted by way of international elements, and it isn't correct to say that traders are transferring completely to different emerging markets. "While there may be global uncertainty, they generally tend to go back to the U.S.," he explained, while also noting the resilience of indian markets. Pandey is confident that regardless of these challenges, India's economy stays the fastest-developing big economy and is well-positioned to hold its increase trajectory regardless of international headwinds.

Sitharaman also touched at the broader financial context, declaring that FPI outflows started out in october 2024, to start with sparked by using China's monetary stimulus measures and later compounded with the aid of concerns over the election of donald trump as U.S. President. These elements caused decreased attractiveness of emerging markets and improved calls for U.S. debt.

On the subject of exchange and tariffs, Sitharaman defined that india has taken various steps to rationalize customs obligations, which includes reviewing protect and anti-dumping obligations. "This price range marks a good-sized development in reforming India's customs obligation structure," she added, emphasizing the U.S.'s ongoing efforts to become more investor-pleasant. Finance Secretary Pandey highlighted that the U.S. and india have agreed to negotiate a bilateral trade agreement (BTA) in the following couple of months for you to cope with reciprocal tariffs and, in addition, facilitate exchange.

Finally, Sitharaman commented on India's inflation control, pointing out that inflation is well within a managed range, with the brand new figures displaying inflation near four percent. The authorities, in coordination with the reserve bank of india (RBI), are taking delivery-aspect measures and financial policy actions to preserve inflation in the take a look at. This has contributed to the RBI's choice to reduce interest prices for the first time in nearly 5 years, with a 25 basis point discount inside the repo price to 6.25% in advance this month. The RBI has additionally maintained its inflation forecast for FY25 at 4.8%, with GDP increase projected at 6.7% for FY26.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel