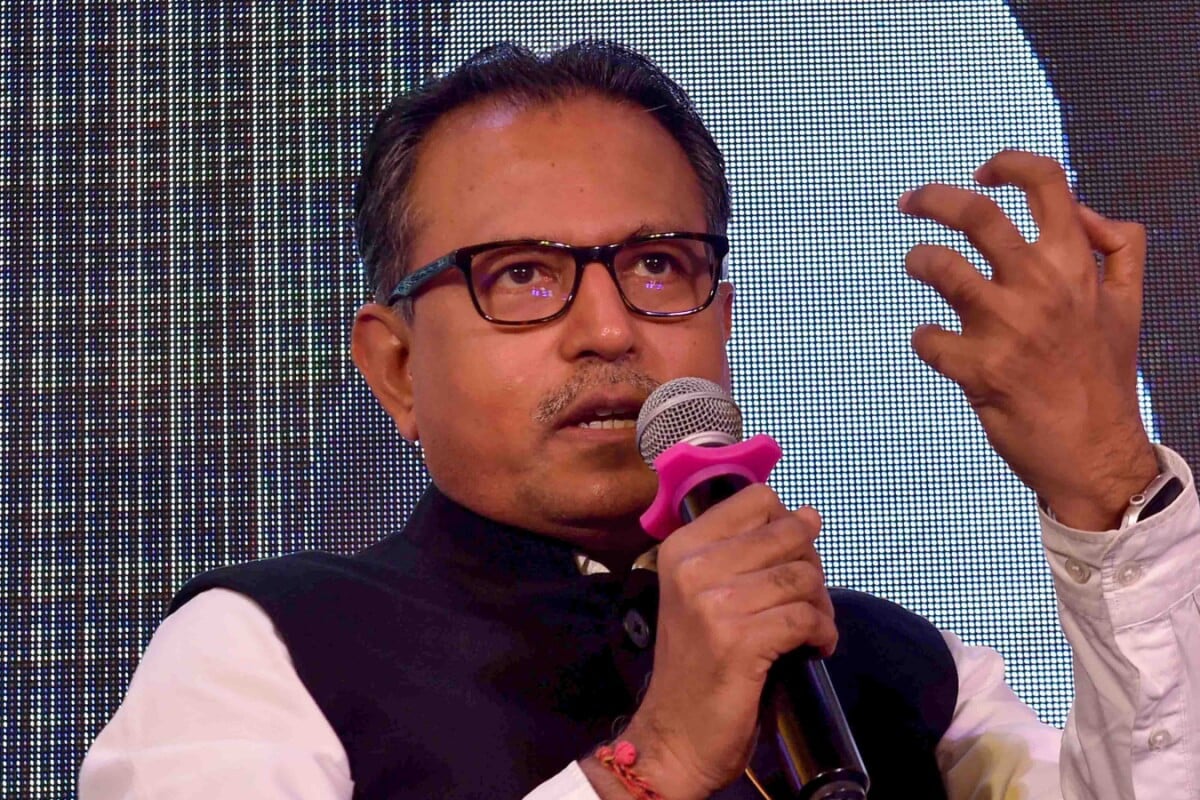

Kotak mahindra AMC MD Nilesh Shah Urges Investors To Buy Amid Market Slowdown; Here's Why

The indian inventory markets have experienced a downward trend in the latest months, inflicting uncertainty amongst investors. But Nilesh Shah, managing director of mahindra BANK' target='_blank' title='kotak mahindra-Latest Updates, Photos, Videos are a click away, CLICK NOW'>kotak mahindra Asset Management Agency, shows that the recent promotion affords a shopping opportunity for discerning long-term buyers.

He advises towards forming market perspectives primarily based totally on the returns of the past six months and instead encourages specialization in acquiring select fine shares.

Speaking to CNBC-TV18 on march four, Shah said, "The Nifty index is currently buying and selling slightly beneath its ancient common valuation, suggesting a marketplace that is reasonably valued. The excesses of the recent past were corrected, potentially providing a beneficial entry point for long-time period buyers to not forget accumulating stocks."

Shah cautioned that the outlook for the approaching months isn't always completely clear. "If FPIs keep selling aggressively, shoppers will possibly call for decreased charges, probably delaying marketplace stabilization."

"By no means stand in front of a moving educate… that is your chance to build up, no longer to shop for the whole lot nowadays," he counseled.

Shah mentioned potential motives in the back of FPIs turning into sellers. Unhappiness stemming from the GDP increase records launched in september and december 2024 is one feasible aspect, he said. Additionally, corporate earnings for the second quarter and 0.33 quarters fell short of expectations, hard valuation justifications.

"The united states President's 'Make the US super once more' talk has pulled money from all emerging markets. Each rising marketplace is facing outflows. china has not posted records on the grounds that october 2024. So, we do not now understand whether they are inflowing or outflowing. But if no person is publishing the records, your speculations can be as correct as mine," Shah stated.

when asked if enhancing the capital profits tax could be a prudent degree to cut down the promote-off, Nilesh Shah stated, "An investor invests, whether or not home or international, and we should deal with them equally." Concurrently, there are calls to reduce taxes for foreign portfolio investors (FPIs), who additionally anticipate stability in taxation.

"Tax reduction does not now guarantee returns. Alternatively, we need to prioritize earnings boom and governance. india has outperformed all other emerging markets, along with china, Brazil, Russia, and South Africa. While the last seven months had been challenging, traders in india have realized income and fulfilled their tax responsibilities. Therefore, a simplistic approach to tax reduction isn't a complete solution," Shah stated.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel