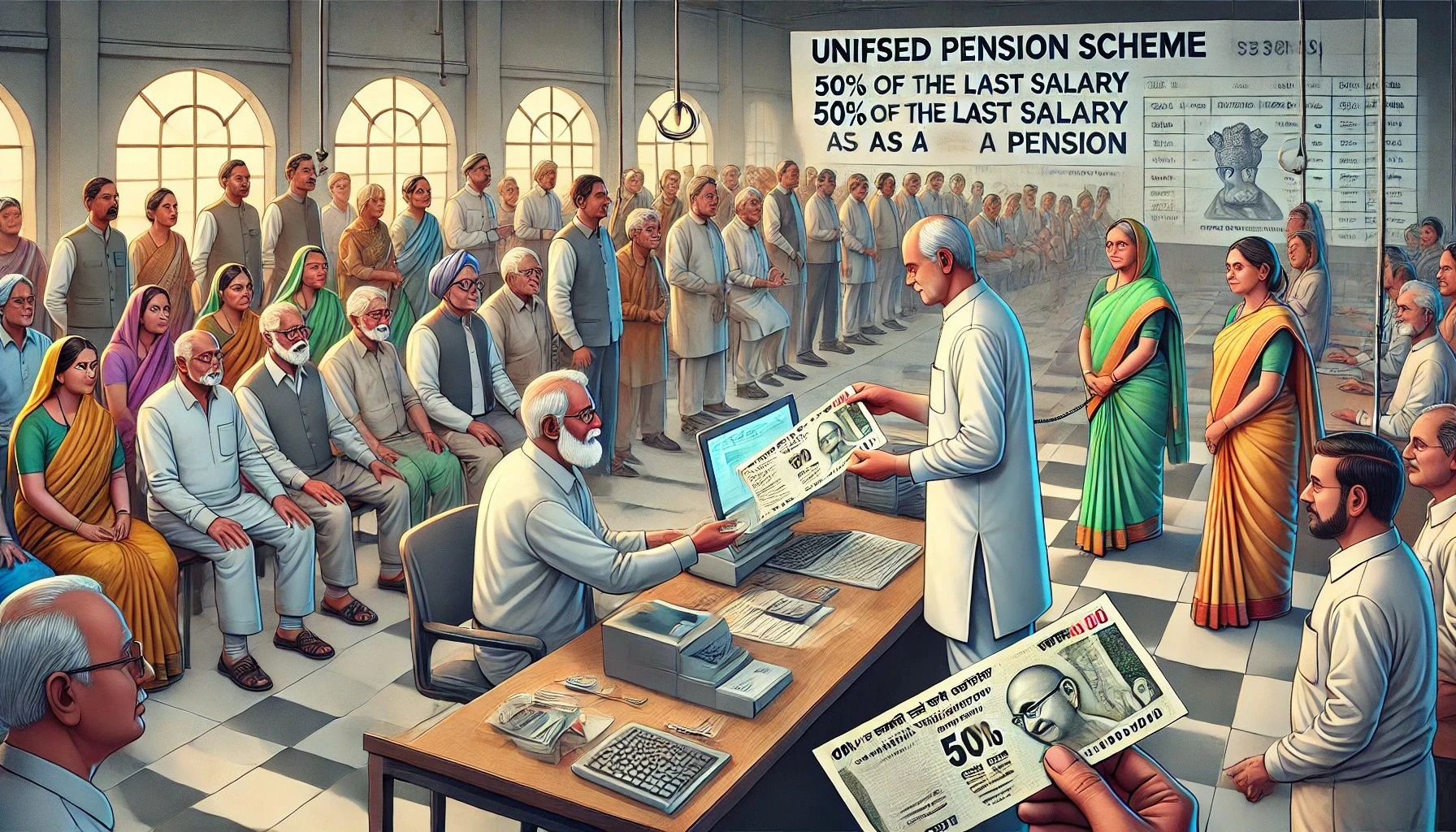

Unified Pension Scheme: 50% Remaining Profits Pension For Central Executive Personnel

The government of india has announced the Unified Pension Scheme (UPS), a landmark initiative aimed at providing principal government employees with an assured pension of fifty percent of their closing salary. This scheme, added in early 2025, is ready to return to impact from april 1, 2025, as an alternative to the National Pension Scheme (NPS). The U.S. is designed to address the long-status call for the recovery of the old Pension Scheme (OPS) and make certaineconomicSafety for authorities employees put up retirement.

Why was the Unified Pension Scheme brought in?

For years, principal authorities employees were advocating for the return of the antique Pension Scheme (OPS), which furnished a fixed pension equal to 50% of their ultimate drawn income. The creation of NPS in 2004 changed the OPS with a marketplace-related pension, mainly due to uncertainty regarding retirement blessings. USABridges this gap with the aid of reinstating a relaxed pension shape, ensuring financial stability for retirees while incorporating a few revised contribution mechanisms.

Key capabilities of the Unified Pension Scheme (UPS)

The Unified Pension Scheme introduces a based contribution model, reaping rewards for both current and future authorities employees. the important thing functions include:

50% ultimate earnings Pension: personnel retiring under U.S. law will acquire half of their ultimate drawn salary as a pension, supplying a strong post-retirement income.

Balanced Contribution shape: personnel will make contributions of 10% of their basic earnings and dearness allowance (DA), whilst the government will make a contribution of 18.5% toward the pension fund.

Additional government aid: A separate pool fund might be installed, where the authorities will contribute an extra 8.5%, ensuring sufficient reserves for sustainable pension disbursements.

Minimum pension guarantee: Employees who've served at least 10 years may be entitled to a minimal month-to-month pension of ₹10,000, ensuring monetary safety even for lower-earning employees.

Proportional Pension for Mid-provider Retirees: personnel with 10 to 25 years of carrier will receive proportional pension advantages, making retirement plans more bendy.

Circle of relatives Pension in Case of death

In the unlucky event of a worker's loss of life, 60% of the pension can be provided to their circle of relatives, ensuring economic balance for dependents.

Gratuity & Lump-Sum advantages: Retirees will obtain a gratuity payout along with a lump-sum retirement gain, in addition to improving financial safety post-retirement.

Eligibility criteria and beneficiaries The Unified Pension Scheme (UPS) will benefit:

All principal authorities employees: The scheme is applicable to each existing and destiny personnel of the important government.

Employees with over 10 years of service: those who've completed no less than 10 years in an authority career may be eligible for pension blessings.

Employees Retiring After 25 Years of Career: Such individuals may be entitled to full pension blessings upon reaching the authentic retirement age.

Pre-America Retirees also Eligible: Personnel who retired before the implementation of the USA also can choose to enter the scheme. They may obtain pension arrears calculated based on Public Provident Fund (PPF) interest rates, ensuring equity in reimbursement.

How does the united states compare to NPS and OPS?

Feature vintage Pension Scheme (OPS), countrywide Pension Scheme (NPS), and Unified Pension Scheme (UPS) Pension kind constant 50% of last revenue marketplace-related returns fixed 50% of ultimate earnings employee contribution None 10% of primary + DA 10% of simple + DA authorities Contribution fully funded 14% of simple + DA 18.5% of fundamental + DA + 8.5% in pool fund minimal pension No minimal guarantee relies upon the market.

overall performance ₹10,000 according to the month family Pension 50% of pension depending on corpus 60% of pension Arrears for Pre-Scheme Retirees no longer applicable. No longer relevant, yes, based totally on PPF hobby quotes.

Authorities’s attitude on USA implementation

The government sees the united states of America as a balanced method, addressing personnel's demands at the same time as ensuring long-term fiscal sustainability. Unlike the OPS, which became totally authority-funded, the U.S. introduces a contribution-primarily based system that secures worker advantages at the same time as reducing long-term financial burdens.

A senior authorities official stated:

"The Unified Pension Scheme is designed to provide financial protection to our relevant authorities employees at the same time as making sure the gadget remains sustainable. It consists of the high-quality elements of OPS and NPS, developing a fair and established pension framework."

Public Response and Worker Sentiment

The introduction of America has been welcomed via imperative government personnel, especially people who have been against NPS because of its dependency on marketplace fluctuations. Exchange unions and worker associations have largely expressed pride with the restoration of a guaranteed pension, even though some still demand a whole return to OPS.

A government employee from the schooling area shared:

"This scheme offers us peace of thoughts. Knowing that fifty percent of our final profits are secured, we can retire without worrying about marketplace overall performance."

What's next? Usa Rollout and destiny tendencies

The Unified Pension Scheme may be absolutely implemented from april 1, 2025.

Personnel can start contributing under the brand-new structure in the approaching financial 12 months.

Similarly, clarifications on pension calculation, withdrawal guidelines, and further advantages are predicted to be released in the coming months.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel