The earnings tax branch has brought some large adjustments underneath the new tax regime, which came into effect on april 1, 2024. This regime gives decreased tax prices with sure deductions and rebates that could help reduce your tax liability.

Expertise and utilizing these benefits efficiently, even as submitting your earnings tax returns (ITR), can lead to big tax savings.

What's blanketed in the New Tax Regime?

The new tax gadget simplifies taxation by way of presenting decreased prices; however, it comes with limited exemptions as compared to the vintage machine. While popular exemptions like HRA, LTA, 80C, and domestic loan interest are now not to be had, there are nevertheless some valuable tax-saving opportunities.

Key blessings of the new tax regime:

standard deduction of ₹75,000

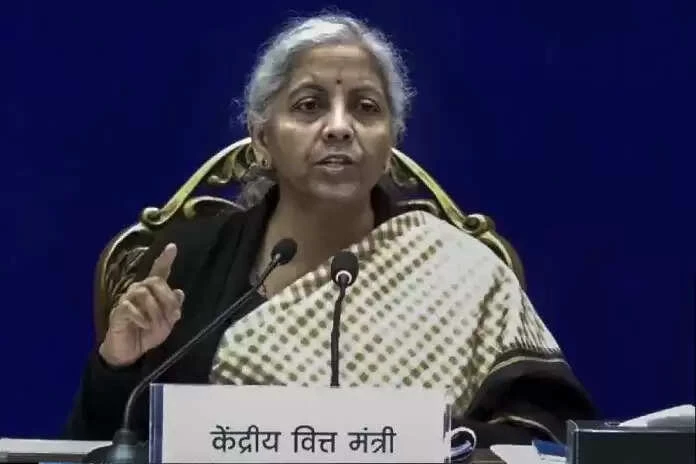

In budget 2024, Finance minister Nirmala Sitharaman introduced an increase in the widespread deduction for earnings and pension income to ₹seventy five,000 (up from ₹50,000). this indicates ₹seventy five,000 may be deducted out of your profits or pension earnings, decreasing your taxable earnings without delay.

Exemption on business enterprise Contribution to NPS

if your organization contributes in your country wide Pension Scheme (NPS) account, the amount contributed could be tax-free beneath phase 80CCD(2). but, please observe that your very own contributions to NPS aren't tax-exempt below this provision.

Exemption on Agniveer Corpus Fund

youth recruited underneath the Agneepath Yojana can avail of a tax exemption beneath segment 80CCH on the quantity received within the Agniveer Corpus Fund.

Tax Deduction on own family Pension

if you receive a own family pension, you could declare a tax deduction of as much as ₹25,000 beneath the brand new tax device, decreasing your normal tax legal responsibility.

Exemption on Allowances (HRA, LTA, etc.)

While HRA and LTA are usually considered exempt under the brand-new regime, these exemptions follow allowances given by means of the organization. Additionally, gifts up to ₹50,000 from pals or circles of relatives are tax-loose.

Rebate below section 87A

The section 87A rebate has been expanded from ₹25,000 to ₹60,000 from FY 2025-26. If your taxable profits are ₹7 lakh or less, you'll no longer be required to pay any income tax.

New vs. antique tax regime: which is better for you?

antique tax regime New Tax Regime

Tax costs: better Tax costs: decrease

Deductions: Many (e.g., 80C, 80D, HRA) Deductions: constrained (simplest 5)

Complexity: extra (files, investments) Simplicity: less (trustworthy)

fine For buyers, HRA claimants quality For: Tax savers without investments

Tax Professional Opinion:

In case you take complete advantage of deductions like 80C, 80D, and home loan hobby, the old tax regime is probably more perfect for you. However, in case your profits are straightforward and you don't have many investments, the new tax regime ought to offer great advantages.

click and follow Indiaherald WhatsApp channel

click and follow Indiaherald WhatsApp channel